2022 PCAOB Large Firm Inspection Reports

- Daniel Goelzer

- Mar 8, 2024

- 19 min read

Updated: May 31, 2024

Note

The version of the 2022 KPMG report that the Public Company Accounting Standards Board released on February 28, 2024, along with the reports of the U.S. affiliates of the other global network audit firms, was redacted to omit discussion of one of the 54 KPMG engagements that the PCAOB inspected in 2022. The analysis of the 2022 large firm inspection reports below was based in part on the redacted KPMG report.

On April 26, the PCAOB made public a complete version of KPMG’s 2022 PCAOB inspection report. See Unredacted: KPMG’s 2022 Inspection Report. My analysis has been updated to reflect the complete 2022 KPMG report, and the new version has been posted to auditupdate.com. See 2022 PCAOB Large Firm Inspection Reports – Updated, which supersedes the analysis below.

# # #

On February 28, the PCAOB released the 2022 inspection reports for the U.S. affiliates of the six global network audit firms. (The version of KPMG’s 2022 report that the PCAOB released was not complete in that the Board redacted the discussion of one KPMG engagement.) Overall, the inspection results for these six large firms declined in 2022, compared to 2021 and 2020. While the upward trend in deficiencies is concerning, the 2022 results are not dramatically out of line with the six firms’ past performance. Nonetheless, the firms need to consider and address the root causes of the increasing number of inspection deficiencies. The persistent and growing gap between the performance of the firms with the best and worst inspection records is also a troubling aspect of the 2022 reports.

This post analyzes the 2022 inspection reports of the six global network affiliate firms, compares them to last year’s results and to each other, and offers some observations based on the 2022 reports. Audit committees should review their audit firm's inspection report and discuss it with the engagement partner.

Overview of 2022 Results

In 30 percent of the engagements it inspected for these six firms, the PCAOB found one or more Part I.A deficiencies – that is, deficiencies of such significance that it appeared that the firm did not obtain sufficient evidence to support its opinion. (The KPMG redaction does not affect this percentage.) All six firms had a higher percentage of inspected engagements that were deficient than in 2021. For two firms – EY and PwC – the deficiency rate more than doubled from the prior year, although PwC’s 2022 deficiency rate remained in the single digits, while almost half of EY’s inspected engagements (46 percent) contained a deficiency in 2022. See Tables 1 and 2.

As in the 2020 and 2021 inspection cycles, PwC’s results were the best in the group. In 2022, the Board found deficiencies in five out of 54 PwC audits it inspected – 9 percent; in 2021, the Board found deficiencies in two PwC engagements (3 percent) of 56 PwC engagements inspected. Deloitte maintained its second-place position, with nine deficient engagements in its 2022 inspection report (17 percent of 53 engagements inspected). At the other end of the spectrum, BDO, as in 2021, had the highest percentage of deficient engagements – the Board found problems in 19 (66 percent) of the 29 engagements it inspected, up from 53 percent last year.

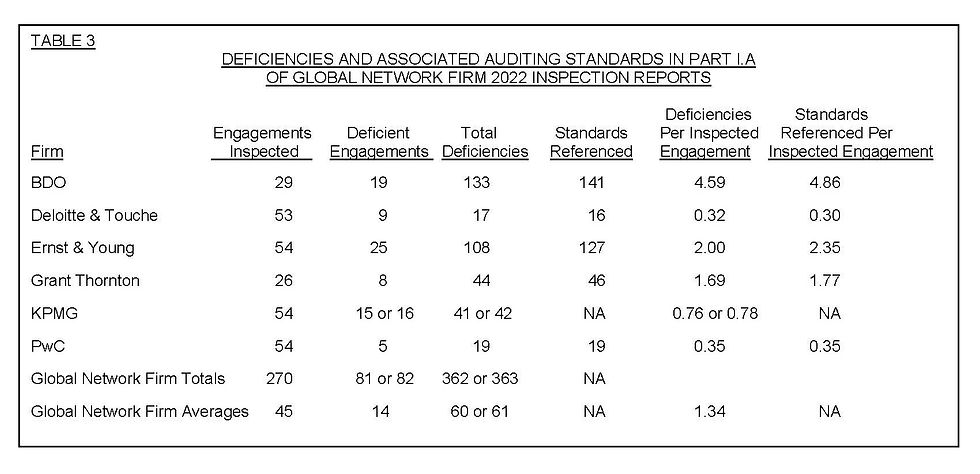

Another way of looking at a firm’s inspection results is to compare the number of auditing standard violations the Board referenced to the number of engagements inspected. See Table 3. Deloitte and PwC were also best-in-class by this metric. For Deloitte, the Board inspected 53 engagements and referenced 16 auditing standards in Part I.A of its report – 0.30 standards per inspected engagement. For PwC, the result was almost the same – 0.35 standards referenced per inspected engagement. In contrast, for BDO and EY the comparable numbers were 4.86 and 2.35 standards per inspected engagement, respectively.

As has been the case for many years, flaws in the audit of internal control over financial reporting (ICFR) were the major cause of deficient audit engagements. Excluding KPMG, inspectors found ICFR audit deficiencies in 28 percent of integrated audits they inspected in 2022, up from 19 percent in the 2021 global network firm inspections. Seventy percent of audit engagements described in Part I.A of the 2022 inspection reports of the five firms for which complete reports were released included an ICFR deficiency. AS 2201, An Audit of Internal Control Over Financial Reporting That is Integrated with An Audit of the Financial Statements, was the most frequently cited auditing standard by a wide margin. See Table 4.

Inspection reports also include a section (Part I.B) describing instances of non-compliance with PCAOB standards or rules that do not relate directly to the sufficiency or appropriateness of the evidence supporting an audit opinion and a section (Part I.C) describing instances of potential non-compliance with the rules related to auditor independence. The six global network firm 2022 reports include 139 Part I.B deficiencies – a 50 percent increase over 2021. The most common Part I.B finding was the failure of the engagement team to perform procedures to determine whether a matter should have been disclosed in the auditor’s report as a critical audit matter (CAM). See Tables 6 and 7. For the six firms as a group, 401 instances of non-compliance with the independence rules were described in Part I.C., of which 392 were firm self-reported. Most of these instances involved a prohibited investment in an audit client, often by someone who was not on the engagement team. In all cases where the firm was the principal auditor, the firm determined that the instance of non-compliance did not impair its objectivity and impartiality. See Tables 8 and 9.

For last year’s analysis of the 2021 inspection reports of the six global network member firms, see 2021 PCAOB Large Firm Inspection Reports, January 2023 Update. For the PCAOB staff’s summary of all 157 audit firm inspections in 2022, see 2022 PCAOB Inspections Preview Says 40 Percent of Audits Reviewed Had Deficiencies, July 2023 Update.

Impact on Analysis of the KPMG Report Redactions

Because of the redactions from KPMG’s report, it is not possible to fully compare its 2022 results to those of the other five firms. However, a fairly complete picture of KPMG’s inspection can be deduced from the information available.

Part I.A of the redacted KPMG report describes 15 engagements in which the Board found deficiencies. These 15 engagements are for companies described as Issuer A through Issuer M, Issuer O, and Issuer P. Between the description of Issuer M and the description of Issuer O there is a redaction. It seems clear that the redacted material is the PCAOB’s description of the audit of a sixteenth client – Issuer N. The redaction is in the section of the report captioned “Audits With a Single Deficiency.” Because the description of Issuer N is omitted, the report also omits a range of information that depends on that description – e.g., the total number of references to specific auditing standards in Part I.A.

Neither the PCAOB nor KPMG have made a public statement concerning the reason for the redactions. However, it seems likely that KPMG has exercised its right under the Sarbanes-Oxley Act to appeal the PCAOB’s findings as to Issuer N to the SEC. Under the SEC rule governing appeals of inspection reports, the PCAOB may release the portions of the report that are not subject to the appeal while the appeal is pending. That appears to be what has happened. Presumably, once the appeal is decided, the PCAOB will release a complete KPMG 2022 report that will either include Issuer N and a description of its single deficiency or exclude Issuer N.

If this explanation of the redactions is correct, KPMG’s final inspection report will contain either 15 or 16 Part I.A engagements, depending on whether Issuer N is included. Further, since the 15 engagement descriptions in Part I.A of the redacted report contain 41 deficiencies, the final KPMG report will include either 41 or 42 deficiencies. Tables 1 and 3 reflect these alternative possible outcomes.

2022 Firm Inspection Report Synopses

Below is a 2022 inspection report synopsis for each of the six U.S. affiliates of the global network firms:

BDO USA, LLP. The PCAOB reviewed 29 BDO issuer audits, 19 of which were integrated audits of both the financial statements and ICFR. In 19 of the 29 audits (66 percent), the PCAOB staff identified deficiencies of such significance that it appeared that the firm had not obtained sufficient appropriate audit evidence to support its opinion. This compares to BDO’s 53 percent deficient engagement rate in 2021. In one of the 19 deficient engagements, the issuer’s financial statements were determined to be materially misstated and were subsequently corrected in a restatement. Nine of the 19 engagements in Part I.A included deficiencies related to both the audit of the financial statements and of ICFR; nine included only a financial statement audit deficiency; and one included only an ICFR audit deficiency. The PCAOB described 133 audit deficiencies (4.59 deficiencies per inspection) associated with 141 auditing standards (4.86 standards per inspection) in the 19 engagements in Part I.A. In Part I.B of the inspection report, the PCAOB identified 16 instances of noncompliance with PCAOB standards or rules that did not relate directly to the evidence the firm obtained to support an opinion. In Part I.C., the Board described no instances it had identified of potential non-compliance with independence rules and eight instances that the firm had identified.

Deloitte & Touche LLP. The PCAOB reviewed 53 Deloitte issuer audits, 37 of which were integrated audits of both the financial statements and ICFR. In nine of the 53 audits (17 percent), the PCAOB staff identified deficiencies of such significance that it appeared that the firm had not obtained sufficient appropriate audit evidence to support its opinion. This compares to D&T’s 13 percent deficient engagement rate in 2021. Six of the nine engagements in Part I.A included deficiencies related to both the audit of the financial statements and of ICFR, and three included only a financial statement audit deficiency. The PCAOB described 17 audit deficiencies (0.32 deficiencies per inspection) associated with 16 auditing standards (0.30 standards per inspection) in the nine engagements in Part I.A. In Part I.B of the inspection report, the PCAOB identified 25 instances of noncompliance with PCAOB standards or rules that did not relate directly to the evidence the firm obtained to support an opinion. In Part I.C., the Board described no instances it had identified of potential non-compliance with independence rules and 129 instances that the firm had identified.

Ernst & Young LLP. The PCAOB reviewed 54 EY issuer audits, 47 of which were integrated audits of both the financial statements and ICFR. In 25 of the 54 audits (46 percent), the PCAOB staff identified deficiencies of such significance that it appeared that the firm had not obtained sufficient appropriate audit evidence to support its opinion. This compares to EY’s 21 percent deficient engagement rate in 2021. Twenty of the 25 engagements in Part I.A included deficiencies related to both the audit of the financial statements and of ICFR, and five included only a financial statement audit deficiency. The PCAOB described 108 audit deficiencies (2.00 deficiencies per inspection) associated with 127 auditing standards (2.35 standards per inspection) in the 25 engagements in Part I.A. In Part I.B of the inspection report, the PCAOB identified 30 instances of non-compliance with PCAOB standards or rules that did not relate directly to the evidence the firm obtained to support an opinion. In Part I.C., the Board described no instances it had identified of potential non-compliance with independence rules and 93 instances that the firm had identified.

Grant Thornton LLP. The PCAOB reviewed 26 Grant issuer audits, 14 of which were integrated audits of both the financial statements and ICFR. In eight of the 26 audits (31 percent), the PCAOB staff identified deficiencies of such significance that it appeared that the firm had not obtained sufficient appropriate audit evidence to support its opinion. This compares to Grant’s 23 percent deficient engagement rate in 2021. Five of the engagements in Part I.A included deficiencies related to both the audit of the financial statements and of ICFR, and three included only a financial statement audit deficiency. The PCAOB described 44 audit deficiencies (1.69 deficiencies per inspection) associated with 46 auditing standards (1.77 standards per inspection) in in the eight engagements in Part I.A. In Part I.B of the inspection report, the PCAOB identified 38 instances of noncompliance with PCAOB standards or rules that did not relate directly to the evidence the firm obtained to support an opinion. In Part I.C., the Board described no instances it had identified of potential non-compliance with independence rules and nine instances that the firm had identified.

KPMG LLP (redacted). The PCAOB reviewed 54 KPMG issuer audits, 43 of which were integrated audits of both the financial statements and ICFR. The number of audits in which the PCAOB staff identified deficiencies of such significance that it appeared that the firm had not obtained sufficient appropriate audit evidence to support its opinion is redacted. However, it appears that the final number of Part I.A engagements will be either 15 or 16, representing respectively either 28 percent or 30 percent of the 54 inspected engagements. KPMG’s deficient engagement rate in 2021 was 26 percent. In one of the deficient engagements, the issuer’s financial statements were determined to be materially misstated and were subsequently corrected in a restatement; the issuer also disclosed material weaknesses in its ICFR. Information concerning the number of engagements in Part I.A related to both the audit of the financial statements and of ICFR, to only the financial statement audit, and to only the ICFR audit is redacted. Because of the redactions, it is also not possible to determine the total number of audit deficiencies or of auditing standards associated with the engagements in Part I.A. However, as explained above, it appears that the final number of Part I.A deficiencies will be either 41 or 42, reflecting either 0.76 or 0.78 deficiencies per inspected engagement. In Part I.B of the inspection report, the PCAOB identified 23 instances of noncompliance with PCAOB standards or rules that did not relate directly to the evidence the firm obtained to support an opinion. In Part I.C., the Board described eight instances it had identified of potential non-compliance with independence rules and 24 instances that the firm had identified.

PricewaterhouseCoopers LLP. The PCAOB reviewed 54 PwC issuer audits, 47 of which were integrated audits of both the financial statements and ICFR. In five of the 54 audits (nine percent), the PCAOB staff identified deficiencies of such significance that it appeared that the firm had not obtained sufficient appropriate audit evidence to support its opinion. This compares to PwC’s four percent deficient engagement rate in 2021. Four of the engagements in Part I.A included deficiencies related to both the audit of the financial statements and of ICFR, and one included only an ICFR audit deficiency. The PCAOB described 19 audit deficiencies (0.35 deficiencies per inspection) associated with 19 auditing standards (0.35 standards per inspection) in the five engagements in Part I.A. In Part I.B of the inspection report, the PCAOB identified seven instances of noncompliance with PCAOB standards or rules that did not relate directly to the evidence the firm obtained to support an opinion. In Part I.C., the Board described one instance it had identified of potential non-compliance with independence rules and 129 instances that the firm had identified.

Comparisons of Firm Part I.A Results

Part I.A of a firm’s inspection report describes audit deficiencies of such significance that it appeared that the firm had not obtained sufficient appropriate audit evidence to support its opinion on the financial statements and/or ICFR of the public company under audit at the time the opinion was released. Table 1 compares the results of the 2022 inspections of the U.S. affiliates of the six global network firms. Table 2, which appeared in 2021 PCAOB Large Firm Inspection Reports, January 2023 Update, compares the results of the 2021 inspections of the six global network firms.

Tables 1 and 2 focus on the percentage of inspected engagements that have at least one audit deficiency. Other indicators of the relative performance of the six firms are the number individual audit deficiencies in each report and the number of citations to auditing standards associated with those deficiencies. These metrics differ from the percentage-of-deficient engagements measure because an engagement included in Part I.A may involve more than one deficiency and a deficiency may be associated with more than one auditing standard. Table 3 compares the performance of the six firms based on the number of audit deficiencies in each inspection report and the number of auditing standards associated with those deficiencies. Because of the redactions in KPMG’s 2022 inspection report, it is not possible to determine the aggregate number of auditing standards associated with the Part I.A deficiencies. In some cases, there is an element of judgment in determining the number of deficiencies in a Part I.A engagement description.

Aggregate Part I.A Data on Auditing Standards, Deficiency Descriptions, and Audit Areas

Auditing standards cited in deficiencies. Table 4 lists the auditing standards most frequently cited as the basis for audit deficiencies in Part I.A of the 2022 inspection reports. Table 4 also shows the percentage of all deficiencies that were based on each auditing standard. The same auditing standard may have been cited multiple times in an engagement described in Part I.A. Only standards cited more than once are included in Table 4. Since the PCAOB redacted total auditing standard reference information from KPMG’s report, Table 4 only reflects the inspection reports of the other five global network firms.

Audit deficiencies. In each inspection report, the PCAOB lists the most frequently identified audit deficiencies, divided between the most frequent deficiencies in financial statement (FS) audits and the most frequent deficiencies in ICFR audits. Table 5 aggregates these frequent deficiencies lists for the six firms. Table 5 also indicates what percentage of the engagements in Part I of the six reports included these deficiencies.

Audit/financial statement areas. For each firm, the PCAOB lists the audit areas with frequent Part I.A deficiencies in the inspection report. This information was not redacted from the KPMG report. For the six firms, on an aggregate basis, these areas (excluding those cited only once) are listed below:

Revenue and related accounts – 44 deficiencies.

Inventory – 12 deficiencies.

Business combinations – 11 deficiencies.

Long-Lived Assets – 4 deficiencies.

Allowance for credit losses/Allowance for loan losses – 3 deficiencies.

Goodwill and intangible assets – 3 deficiencies.

Deposit liabilities – 2 deficiencies.

Other Instances of Non-Compliance: Six Firm Part I.B Results

Part I.B of an inspection report describes instances of non-compliance with PCAOB standards or rules that do not relate directly to the sufficiency or appropriateness of the evidence supporting an audit opinion. In 2022, the PCAOB found an aggregate of 139 such deficiencies, compared to 93 in 2021. Table 6 presents the number of Part I.B deficiencies for each of the six firms and shows how each firm’s 2022 Part I.B results compare to its 2021 report. Year-to-year comparisons may provide general insight into Part I.B trends but should be interpreted with caution. It appears that the PCAOB does not review all inspected engagements for every type of Part I.B deficiency. Therefore, the number of Part I.B deficiencies in a firm’s inspection report may not be directly comparable to the number in other firms’ reports or to the number reported in prior years.

Table 7 lists the most frequent Part I.B deficiencies in the six reports. Only deficiencies cited more than once are included.

Independence: Comparison of Firm Part I.C Results

The 2022 inspection reports contain a new section – Part I.C. Part I.C discusses instances of potential non-compliance with SEC or PCAOB rules related to maintaining auditor independence. Part I.C describes both instances of potential noncompliance that the PCAOB identified and instances that the firm self-reported to the Board during the inspection. Across the six global network firms, the Board identified nine instances of independence rule noncompliance and the firms reported 392.

As the Board points out, disclosure in Part I.C of an instance of potential non-compliance with the independence rules does not necessarily mean that the Board (or the firm) has concluded the firm was not objective and impartial throughout the audit and professional engagement period. In all 392 firm-reported cases, if the firm involved was the principal auditor, it evaluated the potential non-compliance and determined that its objectivity and impartiality were not impaired.

Table 8 presents the Part I.C instances of potential non-compliance with the independence rules for each of the six firms. However, each inspection report contains the following warning:

“While we have not evaluated the underlying reasons for the instances of potential non-compliance, the number, large or small, of firm-identified instances of potential non-compliance may be reflective of the size of the firm, including the number of non-U.S. associated firms in the global network; the design and effectiveness of the firm’s independence monitoring activities; and the size and/or complexity of the issuers it audits, including the number of affiliates of the issuer. Therefore, we caution against making any comparison of these firm-identified instances of potential non-compliance across firms.”

Each inspection report describes the most common instances of potential independence non-compliance in the firm-reported cases. Table 9 lists these independence issues on an aggregate basis. Because the descriptions in each inspection report include only the most common instances, Table 9 does not reflect all 392 firm-reported potential non-compliance instances.

Comments on 2022 Global Network Firm U.S. Affiliate Inspections

The PCAOB cautions that inspection results are not necessarily comparable over time or among firms because of variations in the inspection process. While that caveat should be kept in mind, below are seven observations based on the 2022 reports.

Overall, large firm audit quality appears to have declined in 2022. Both the Chair of the PCAOB and the Chief Accountant of the SEC have expressed concern about the increase in inspection findings. See SEC Chief Accountant Calls on Auditors to Improve and on Audit Committees to Be Proactive, February 2024 Update and 2022 PCAOB Inspections Preview Says 40 Percent of Audits Reviewed Had Deficiencies, July 2023 Update. The 2022 inspection reports are consistent with those concerns. For the global network firm affiliates as a group, the 2022 overall deficient engagement rate was 30 percent, compared to 21 percent last year. In particular, EY’s engagement deficiency rate increased from 22 percent to 46 percent, which had a significant effect on the overall average. In addition, inspectors found 1.34 deficiencies for each engagement they inspected at the six firms in 2022, compared to 0.77 deficiencies per inspection in 2021.

While concerning, these results are not dramatically out of line with past performance. For example, the 2022 averages are similar to those in 2017, when the Big Four deficiency rate was 30 percent. In context, the 2022 inspections do not suggest that there is a crisis or structural deterioration in auditing. In part, the 2022 results likely reflect the impact of the pandemic on recruiting, training, and the work environment in late 2021 and early 2022 when these audits were performed. Nonetheless, the upward trend in deficiencies over the last few years needs to be addressed.

There continue to be pronounced differences between the inspection results of the large firms The gap between the firm with the lowest percent of inspected engagements that were deficient (PwC – 9 percent) and the firm with the highest percentage (BDO – 66 percent) was 57 percentage points. In 2021, that gap was 49 percent (4 percent for PwC versus 53 percent for BDO). Looking only at the Big Four, EY’s deficiency rate of 46 percent is more than five times PwC’s rate; hopefully, 2022 will prove to be an outlier year for EY.

There is also wide dispersion between the firms based on the number of individual audit deficiencies and of auditing standards cited in Part I.A of each report. In the 2022 PwC inspection, the inspectors found 19 audit deficiencies associated with 19 auditing standards in five Part I.A engagements out of 54 engagements inspected – an average of 0.35 audit deficiencies and 0.35 standards citations per inspected engagement. At Deloitte, 53 inspections resulted in 17 deficiencies associated with 16 auditing standards in nine Part I.A engagements or 0.32 deficiencies and 0.30 standards citations per inspected engagement. At the other end of the spectrum, in 29 BDO engagements inspected, the PCAOB staff found 133 deficiencies and cited 141 standards, an average of 4.59 audit deficiencies and 4.86 standards citations per inspected engagement. In between these extremes, EY and Grant had deficiency-per-inspection rates of 2.00 and 1.69, respectively. KPMG’s rate will likely be either 0.76 or 0.78 deficiencies per inspected engagement – a slight improvement over 0.94 last year.

The share of engagements selected for inspection on a random basis decreased in 2022, which may have impacted inspection findings. The PCAOB has been increasing the percentage of inspected engagements selected at random, rather than based on risk. In 2021, random selections rose to 44 percent – almost half of all inspected engagements for the six global network firms. The PCAOB appears to have changed course in 2022. Only 24 percent of the 2022 inspections for these firms were random selections.

It is possible that the increase in 2022 Part I.A engagement deficiencies is partly the result of this change in the mix of engagement selections. Deficiencies are presumably less likely to be found in engagements selected at random than in those selected based on an assessment of the engagement’s inherent risk. In fact, in its July 2023 preview of the 2022 inspection results, the PCAOB staff noted that, for all 2022 inspections, 26 percent of randomly selected engagements were included in Part I.A, while 42 percent of risk-based selected were included in Part I.A. See 2022 PCAOB Inspections Preview Says 40 Percent of Audits Reviewed Had Deficiencies, July 2023 Update.

ICFR audit deficiencies continue to drive inspection results, but the focus on financial statement issues is increasing. Excluding KPMG, inspectors found ICFR audit deficiencies in 28 percent of integrated audits inspected in 2022, up from 19 percent in the 2021 global network firm inspections. Seventy percent of audit engagements described in Part I.A of the 2022 inspection reports of the five firms for which complete reports were released included an ICFR deficiency. However, despite the overall frequency of ICFR audit deficiencies, the most common deficiency identified in the 2022 inspections related to financial statement audits, not ICFR audits: Twenty percent of all deficiencies in Part I.A of the six reports was “Did not perform sufficient testing related to a significant account or disclosure or to address an identified risk” in the financial statement audit. The second and third most frequent deficiencies were ICFR audit related: “Did not perform sufficient testing of the design and/or operating effectiveness of controls selected for testing” (17 percent of all deficiencies) and “Did not identify and test any controls that addressed the risks related to a significant account or relevant assertion” (16 percent of all deficiencies).

.

Failure to test information provided by the entity, overreliance on controls, and insufficient testing of estimates were frequent issues in financial statement audits. Excluding KPMG, 97 percent of global network firm Part I.A engagements included a financial statement audit deficiency, compared to 79 percent of Part I.A engagements in 2021. As noted above, the most frequent 2022 Part I.A deficiency affecting the financial statement audit was insufficient testing related to a significant account, disclosure, or risk. The other top financial statement audit deficiencies were “Did not perform sufficient testing of data or reports used in the firm’s substantive testing” (14 percent of Part I.A deficiencies), “Did not obtain sufficient evidence as a result of overreliance on controls (due to deficiencies in testing controls)” (13 percent), and “Did not sufficiently test an estimate” (7 percent).

Part I.B deficiencies continue to increase. Part I.B deficiencies increased sharply in 2022. The six 2022 reports include 139 Part I.B deficiencies – a 50 percent increase from 93 Part I.B deficiencies in 2021 and more than twice the 63 in 2020. It is not clear whether these increases reflect more underlying deficiencies or more PCAOB inspection focus on Part I.B issues.

As in 2021, the Part I.B issue with by far the most findings in 2022 was failure of the engagement team to perform procedures to determine whether particular matters related to material accounts that were communicated to the audit committee should have been disclosed as CAMs in the auditor’s report. The second most frequent Part I.B deficiency was inaccurate or incomplete reporting on Form AP regarding the participation of other accounting firms or individuals in the audit. The PCAOB has brought several recent enforcement actions based on Form AP violations and this seems to be an area of current emphasis. Failure to make various types of required audit committee communications was also a frequent Part I.B deficiency.

Independence violations are surprisingly frequent but, in the view of the firms, seldom impair objectivity. The six global network firms self-reported an aggregate of 392 instances of non-compliance with the independence rules, and the PCAOB uncovered 9 more instances. The great majority of these involved a prohibited financial interest in a client, including investment by another partner in the same office as the engagement partner in the audit client, sometimes through what the reports describe as investments in broad-based funds. In all instances of non-compliance described in Part I.C where the firm was the principal auditor, it determined that its objectivity and impartiality were not impaired. The independence rules are complex, and, while any violation should be taken seriously, the large number of instances of non-compliance described in the 2022 reports may be more an illustration of the difficulty in administering the rules across a large organization than of a pattern of lack of independence.

Audit committees should discuss their audit firm’s inspection report with the engagement partner. As noted in past Updates, the audit deficiency descriptions and auditing standard deficiency tables could serve as a discussion topic checklist. Audit committees may also want to understand how the auditor addressed, or plans to address, engagement deficiencies highlighted in its report and whether the report will result in any changes in audit procedures that could affect the company’s audit. Of course, if the company’s engagement was the basis for an inspection finding, the audit committee should understand in depth the cause of the deficiency and how the auditor plans to remedy it and prevent a recurrence. As noted in the 2022 PCAOB Inspections Preview, above, the Board has also urged audit committees to ask their auditor what the firm is doing to address the overall increase in 2022 inspections findings.

Comments